Pacific Exchange Rates Report for January 12th - 16th

- QU Economics Research Team

- 2 days ago

- 2 min read

By: Patrick Gorman, The Quinnipiac University Global Economics Research Team

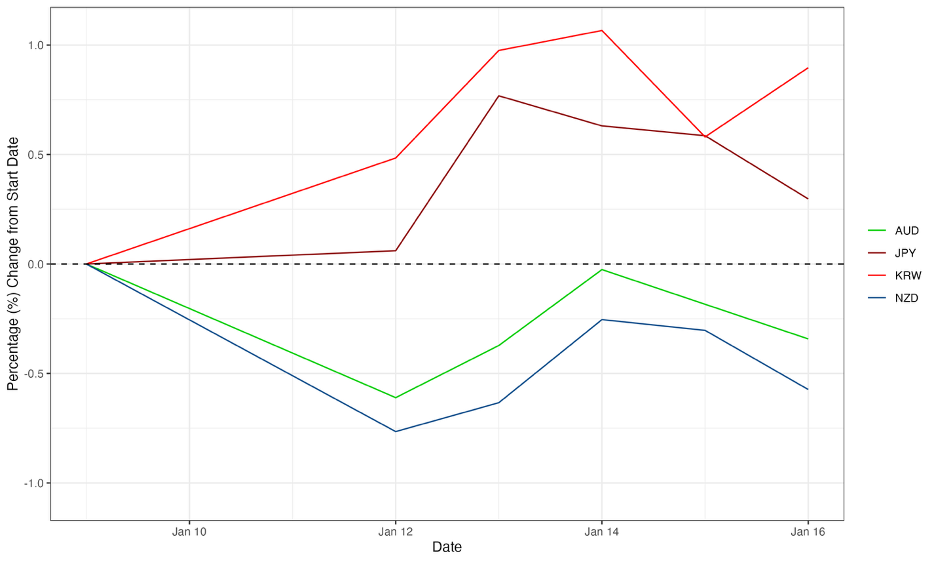

Pacific Currencies Index

Source: Eurostat and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency) and then indexed to be 100 at the start of the period.

For the week of January 12th – January 16th, the Japanese Yen (maroon) and the South Korean Won (red) strengthened while the Australian Dollar (green) and the New Zealand Dollar (blue) weakened. The South Korean Won steadily strengthened throughout the week while the Japanese Yen sharply increased early in the week and then gave back some of the gains later in the week leading to the Won ending the week about .9% stronger and the Yen ending about .3% stronger. The Australian Dollar and the New Zealand Dollar followed similar patterns throughout the week starting with a decline and then a recovery of some of the losses, ending the week with the Australian Dollar weakening about .3% and the New Zealand Dollar weakening about .5%.

Pacific Historical Trends

Source: Eurostat and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency. The center line is a rolling three-month average. The upper and lower boundaries are the average plus and average minus one standard deviation, respectively, for the same three-month period.

For the week of January 12th – January 16th, the Japanese Yen (JPY) was able to push to 3-month highs while the South Korean Won (KRW) was able to come close to reaching 3-month highs. The Australian Dollar (AUD) and the New Zealand Dollar (NZD) stayed around the levels they were at in the past week with some fluctuations inside the week. Both the Australian Dollar and the New Zealand Dollar remain at much lower levels than they have reached in the past 3 months.

Comments