Pacific Exchange Rates Report for June 17 - 21

- QU Economics Research Team

- Jun 24, 2024

- 2 min read

By: Thea Kageleiry, The Quinnipiac University Economics Research Team

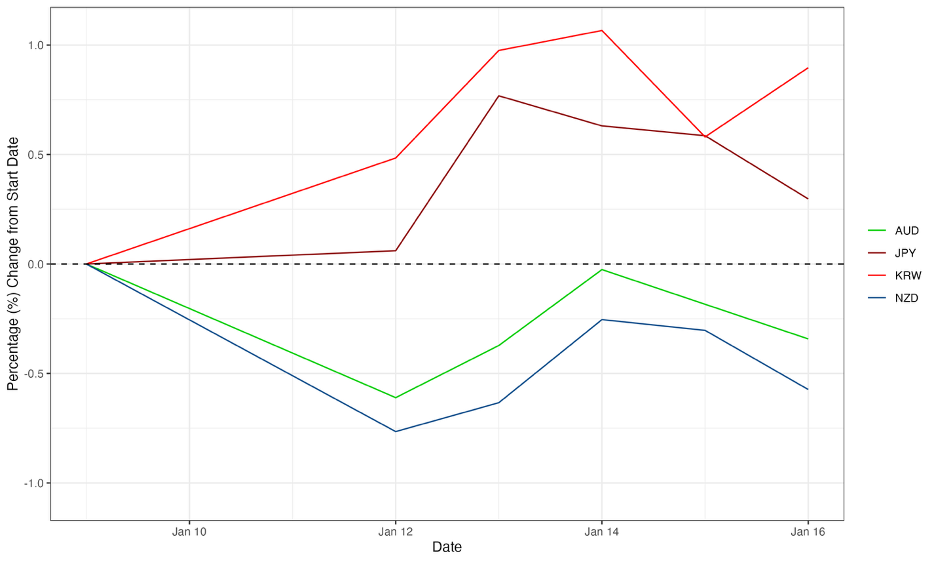

Pacific Currencies Index

Source: Yahoo Finance and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency) and then indexed to be 100 at the start of the period.

Over the course of last week, from June 17th to June 21st, most Pacific exchange rates experienced an overall increase, except for the Australian dollar (green), which steadily declined by about 0.65%. The South Korean won (red) ended the week as the strongest domestic currency among these exchange rates, despite a slight midweek decrease. The New Zealand dollar (blue) increased by about 0.3% over the week, remaining mostly stable. Finally, the Japanese yen (maroon) steadily increased throughout the week, with a total growth of nearly 0.85% from the start of the period.

Pacific Historical Trends

Source: Yahoo Finance and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency. The center line is a rolling three-month average. The upper and lower boundaries are the average plus and average minus one standard deviation, respectively, for the same three-month period.

The behaviors of the currencies over the last week align with the overall trends they have been following in recent months. The increases in the South Korean won (KRW) and the Japanese yen (JPY) solidify and continue the upward path these currencies have been on, while the Australian dollar (AUD) and the New Zealand dollar (NZD) have been decreasing. However, the AUD and NZD did not reach any new lows this week, which could suggest they may start to experience more positive growth in the coming weeks.

Further Reading:

Comments