Primary Commodities Report for July 22 – 26

- Jul 29, 2024

- 2 min read

Updated: Sep 29, 2024

By: Gabriel Kukulka, The Quinnipiac University Economics Research Team

Commodities Index

Source: Yahoo Finance and own calculations. Rates are in United States dollars per one (1) unit of goods. Brent Crude Oil and Natural Gas are measured in barrels, Gold is per ounce, and the ETF is per share. They are all indexed to be at 100 at the start of the period.

During the week of July 22nd to July 26th, the prices of Natural Gas, Nickel, Brent Oil, and Gold all declined for the second consecutive week. Natural Gas (green) initially surged close to 6% at the start of the week but ended with the steepest drop, falling by a total of 5.7%. Nickel (red) saw the second largest decline, consistently decreasing throughout the week to close down 3.3%. Brent Oil (black) experienced a modest decline of 1.8%, while Gold (yellow) had the smallest drop, slipping by just 0.6%.

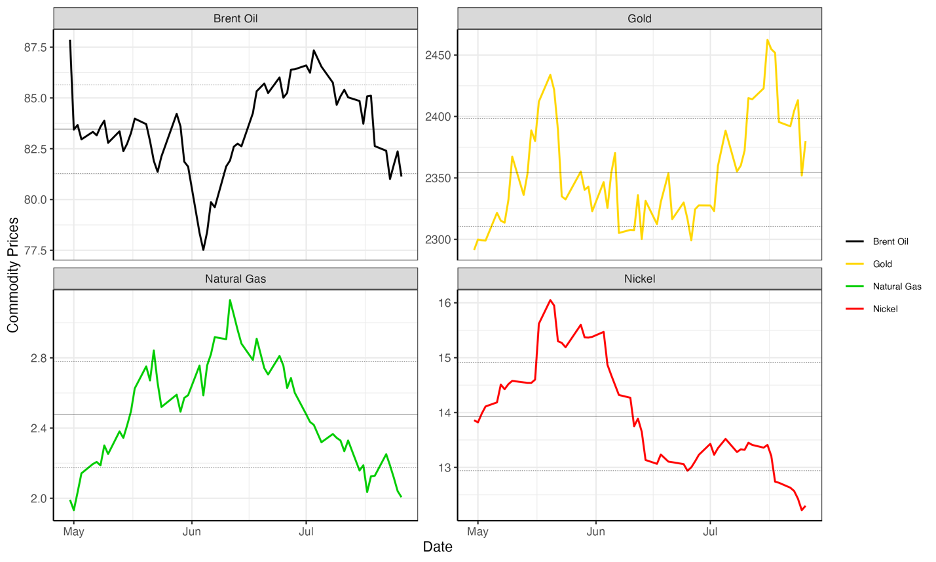

Commodities Historical Trends

Source: Yahoo Finance and own calculations. Rates are in United States dollars per one (1) unit of goods. Brent Crude Oil and Natural Gas are measured in barrels, Gold is per ounce, and the ETF is per share. The center line is a rolling three-month average. The upper and lower boundaries are the average plus and average minus one standard deviation, respectively, for the same three-month period.

With all four commodities seeing a decrease in prices for the second consecutive week, only Gold now sits above its three-month rolling average, albeit not by much. Brent Oil has been on a downward trend throughout July, a pattern to closely monitor as we approach the month's end. Natural Gas prices have continued their rapid descent, plummeting to levels not seen since early May. Nickel prices have also now dropped to multi-month lows. The key question now is: which commodities will see a rebound in prices in August?

Further Reading:

Comments