Trans-Atlantic Exchange Rate Report July 14th – 18th

- QU Economics Research Team

- Jul 27, 2025

- 2 min read

By: Isabella Cortese, The Quinnipiac University Global Economics Research Team

Trans-Atlantic Currencies Index

Source: Eurostat and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency) and then indexed to be 100 at the start of the period.

During the week of July 14th to July 18th, all four tracked currencies showed an overall upward trend from their starting values. By midweek, the Swiss Franc (maroon) saw the strongest growth, peaking around 1.04% on July 17. The euro (blue) and British pound (green) followed closely, with gains just under 1%, while the Canadian dollar (red) showed more modest growth, peaking at 0.46%. Although all four lines dipped slightly by July 18th, they remained above their starting points, indicating a net positive change for the week. The Canadian dollar showed a slower, steadier climb after a slight early-week decline, while the Swiss franc and euro saw sharper midweek increases. Despite the minor pullbacks at the end, the week reflected a positive overall trend in foreign exchange movements for all four currencies.

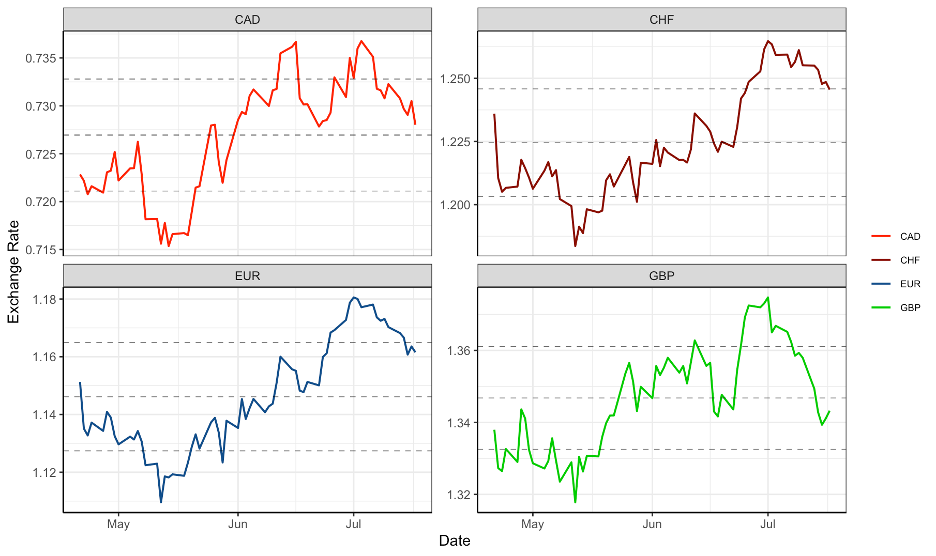

Trans-Atlantic Historical Trends

Source: Yahoo Finance and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency. The center line is a rolling three-month average. The upper and lower boundaries are the average plus and average minus one standard deviation, respectively, for the same three-month period.

From early May to mid-July, all four currencies showed overall appreciation against the USD, with different patterns of growth. The Canadian dollar (CAD) experienced a steady upward trend, marked by periodic jumps in June and early July, before easing slightly toward the end of the period. The Swiss franc (CHF) climbed gradually through May and June, then surged in early July to reach its highest point, followed by a mild decline. The euro (EUR) declined early in the period but began a consistent rise in late May, peaking in mid-July before a modest pullback. The British pound (GBP) also showed steady growth, with increased volatility in late June and early July and a noticeable dip at the end. Despite these fluctuations, all four currencies ended the period higher than where they began, reflecting general strength against the USD.

Comments