CEE Exchange Rates Report for June 24 – 28

- Jul 1, 2024

- 1 min read

By: Zoe McLaughlin, The Quinnipiac University Economics Research Team

CEE Currencies Index

Source: Yahoo Finance and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency) and then indexed to 100 at the start of the period.

During the week of June 24 – June 28, the Czech koruna (red) increased in value relative to the United States dollar by 0.58%, while the Hungarian forint (green) and Polish złoty (blue) decreased. The Romanian leu (purple) remained unchanged relative to the United States dollar. The Polish złoty faced the largest decrease, declining in value by 0.34%, while the Hungarian forint only decreased by 0.10%.

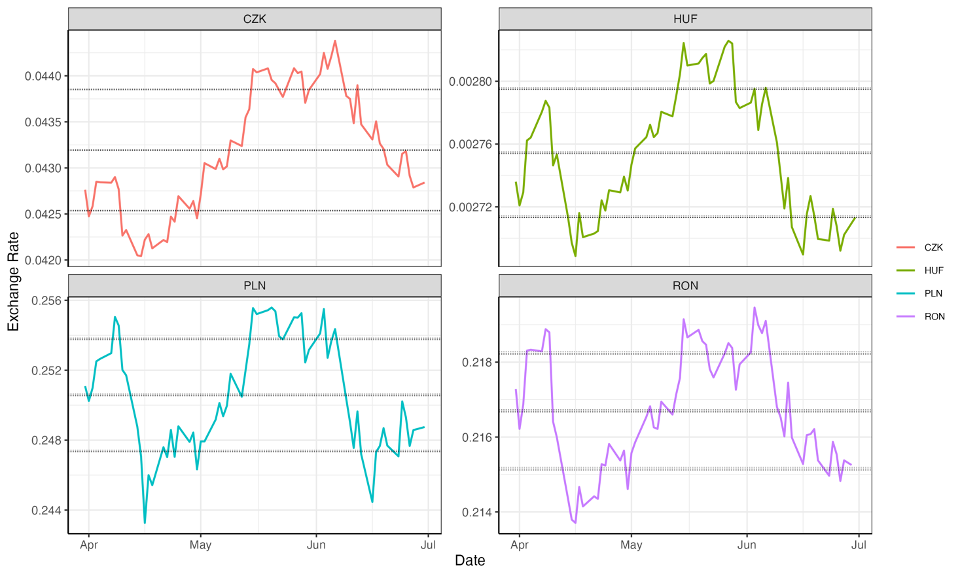

CEE Currencies Historical Trends

Source: Yahoo Finance and own calculations. Exchange rates are inverted to be USD per local currency (i.e., an increase indicates a stronger domestic currency). The center line is a rolling three-month average. The upper and lower boundaries are the average plus and average minus one standard deviation, respectively, for the same three-month period.

These four Central European currencies all remain weaker relative to their three-month averages against the United States dollar. The Hungarian forint (green) is more than one standard deviation below its three-month rolling average, while the Czech koruna (red), Polish złoty (blue), and Romanian leu (purple) are all less than one standard deviation below their three-month rolling averages.

Further Reading:

Comments